Training loans for MS in copyright ordinarily cover tuition costs, study expenses, and living expenditures, rendering it much easier for students to manage their funds. Schooling loans for diploma in copyright cater to students choosing these applications, covering tuition charges and living charges.

Think of your current fiscal situation and no matter whether it could maintain the upcoming every month loan payments. While you don’t really need to pay your loan just before graduation, you could often fork out it though finding out if you have additional funds.

Nevertheless, if you can’t work on this just still, you are able to inquire a relative or a close person who is prepared to cosign a loan along with you. A cosigner has significant financial tasks since they will be held accountable in case you fall short for making your loan payments for whatsoever cause.

Student financial debt has emerged as an important problem during the 2022 presidential election year, which concern is very well-Launched.

four. Loan Application Submission: Comprehensive the loan application kind correctly and post it While using the demanded files to the decided on financial institution or economic institution. Be conscious of any deadlines to stop delays in processing.

A secured training loan for copyright needs you to definitely pledge collateral which include property, fastened deposits, or other useful belongings. These loans frequently give:

Students who now know more than enough about Canadian student loans could get in contact with professional analyze abroad counselors For additional advice.

Loan Acceptance and Disbursement: Upon application assessment and approval, the loan quantity are going to be disbursed on to the academic institution to deal with tuition fees and linked expenditures.

The tenure for the student schooling loan to review overseas is 15 many years and there is no upper limit for the utmost number of loan a person might take.

Many of the things that a borrower really should look at prior to making use of for an affordable education loan in India to review abroad are as follows:

Many community financial institutions or institutions provide a sponsored and affordable rate of curiosity for education loans which is way affordable if when compared with the private banking sector in India.

Automatic Payment Low cost: Borrowers are going to be suitable to receive a 0.25 share position curiosity rate reduction on their own student loans owned by Citizens Financial institution, N.A. in the course of these types of time as payments are needed to be made and our loan servicer is licensed to automatically deduct payments each month from any bank account the borrower designates.

While in the deal with of increasing prices concerning tuition service fees, residing expenditures, and also other miscellaneous expenditures it turns into essential for students planning to go after their scientific tests in the foreign country Student loan for copyright from India ought to apply for a number of The most cost effective education loan selections in India to check abroad.

To obtain a loan, a tough credit rating pull might be asked for with the lender which may affect your credit rating. Costs are subject matter to alter without notice. Not all applicants will qualify for the lowest fee. Least expensive premiums are reserved for the most creditworthy applicants and will depend on credit rating rating, loan term along with other factors. Lowest fees could call for autopay. The autopay low cost won't be applied if Autopay is just not in impact. See loan agreement for aspects.

Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Heather Locklear Then & Now!

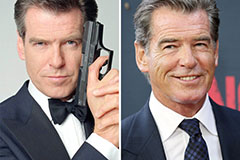

Heather Locklear Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!